The average S&P 500 stock — not just the 'Magnificent Seven' — is overvalued, Goldman says. The average S&P 500 stock has joined the "Magnificent Seven" in overvalued territory, according to Goldman Sachs Group.Goldman Sachs Research found that while investors usually think of elevated concentration as a sign of downside risk, the S&P 500 rallied more often than it declined during the 12 months following past episodes of peak concentration.The S&P 500 is largely considered an essential benchmark index for the U.S. stock market. Composed of 500 large-cap companies across a breadth of industry sectors, the index captures the pulse of the American corporate economy.

Has the S&P 500 ever had a negative year : For the 89 years ended December 31, 2014, the S&P 500 Index posted positive calendar year returns 73% of the time and negative calendar year returns 27% of the time, with an average calendar year return of 21.47% over the positive years and -14.29% over the negative years. Think long term, diversification, and balance.

Is S&P still worth it

In fact, research shows it's actually harder to lose money with the S&P 500 than it is to make money if you keep a long-term outlook. Analysts at Crestmont Research examined the S&P 500's historic performance to determine how often it was able to earn positive returns in a 20-year period.

What are the most overpriced stocks : Most overvalued US stocks

| Symbol | RSI (14) | Price |

|---|---|---|

| GME D | 93.77 | 48.75 USD |

| NVAX D | 92.69 | 13.48 USD |

| ADMA D | 88.14 | 9.16 USD |

| KOSS D | 88.09 | 6.15 USD |

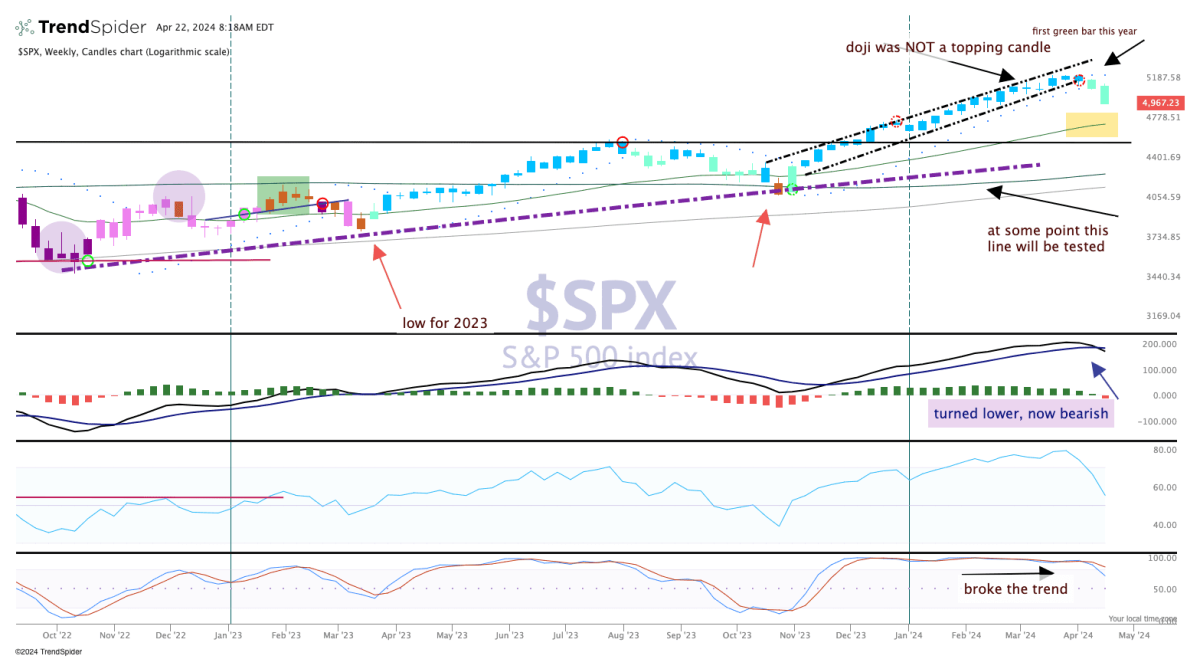

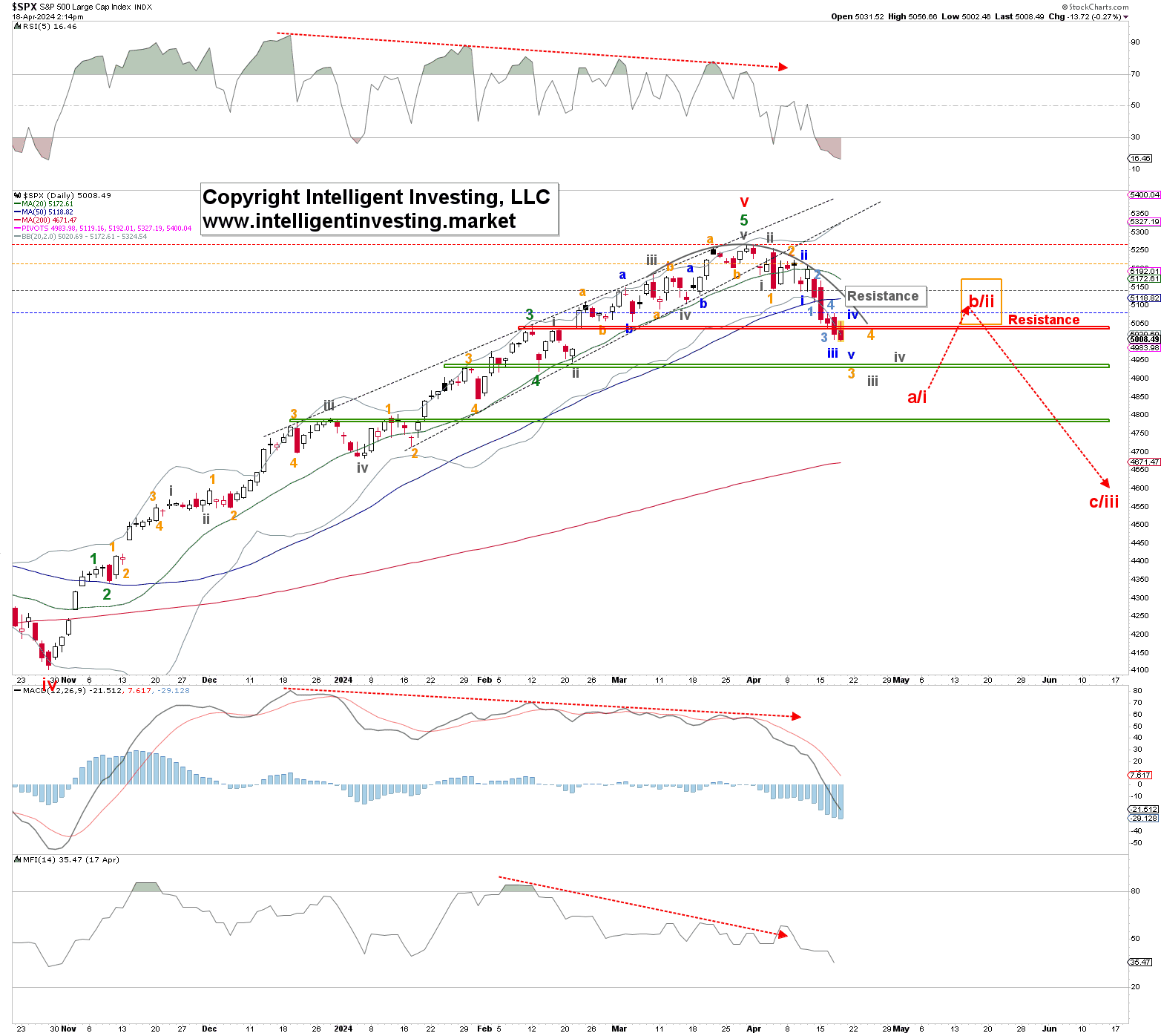

Indicators are pointing to a major correction coming for stocks, market strategist Paul Dietrich says. The B. Riley Wealth chief investment strategist says the market is "bizarrely overvalued." The "smart money," according to Dietrich is moving money into cash.

Magnificent 7 stocks dominate major indexes

- Apple – 6.18 percent.

- Microsoft – 7.02 percent.

- Alphabet – 4.23 percent.

- Amazon – 3.95 percent.

- NVIDIA – 5.09 percent.

- Tesla – 1.17 percent.

- Meta Platforms – 2.31 percent.

What is the downside of S&P

The main drawback to the S&P 500 is that the index gives higher weights to companies with more market capitalization. The stock prices for Apple and Microsoft have a much greater influence on the index than a company with a lower market cap.But if researching and staying up to date on individual companies and their stocks isn't for you, you can still earn great returns by investing in a simple, broad-based index fund like the Vanguard S&P 500 ETF (VOO 0.19%).That does not mean the S&P 500 always goes up. The index has gone down and will continue to go down in certain years. But if growth during the last three decades was spread evenly across that 30-year period, the index would have increased at 10.3% annually.

Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

Is S and Pa safe investment : Investing in an S&P 500 fund can instantly diversify your portfolio and is generally considered less risky. S&P 500 index funds or ETFs will track the performance of the S&P 500, which means when the S&P 500 does well, your investment will, too.

What is the most undervalued stock : 10 Most Undervalued Value Stocks To Buy Now

- Aptiv PLC (NYSE:APTV) Number of Q4 2023 Hedge Fund Shareholders: 39. Trailing P/E Ratio: 7.19.

- Lantheus Holdings, Inc. (NASDAQ:LNTH)

- Lamb Weston Holdings, Inc. (NYSE:LW)

- Valaris Limited (NYSE:VAL) Number of Q4 2023 Hedge Fund Shareholders: 47.

What is the most profitable stock ever

The Best Performing Stocks in History

- Coca-Cola. (NASDAQ: KO)

- Altria. (NASDAQ: MO)

- Amazon.com. (NASDAQ: AMZN)

- Celgene. (NASDAQ: CELG)

- Apple. (NASDAQ: AAPL)

- Alphabet. (NASDAQ:GOOG)

- Gilead Sciences. (NASDAQ: GILD)

- Microsoft. (NASDAQ: MSFT)

The Bottom Line. Equities and real estate generally subject investors to more risks than do bonds and money markets. They also provide the chance for better returns, requiring investors to perform a cost-benefit analysis to determine where their money is best held.Based on the latest S&P 500 monthly data, the market is overvalued somewhere in the range of 88% to 149%, depending on the indicator, down from last month's 92% to 154%.

Why is Chipotle stock so high : Business is still booming

While many fast-food restaurants have been struggling with growth lately, Chipotle has still been posting strong numbers. For the first three months of 2024, revenue rose by 14% to $2.7 billion. And its comparable-store sales (comps) were also up 7%.