Identify all your subscriptions. Check your credit card statements for recurring payments. One easy way to do this is use a subscription tracking tool, such as Rocket Money or OneMain Trim, which finds and then helps you cancel subscriptions you no longer want. Second, opt out!Failing to cancel in time usually means you won't get your money back, but that's not always true. Some companies may decide to issue a partial or full refund in certain cases, especially if you request it sooner rather than later.Can I dispute a recurring charge Yes, you can dispute a recurring charge. For streaming services, the provider may immediately cut your access if you dispute your payment. If you've already canceled your subscription but continue to be charged, it's best to contact the merchant to dispute the charge directly.

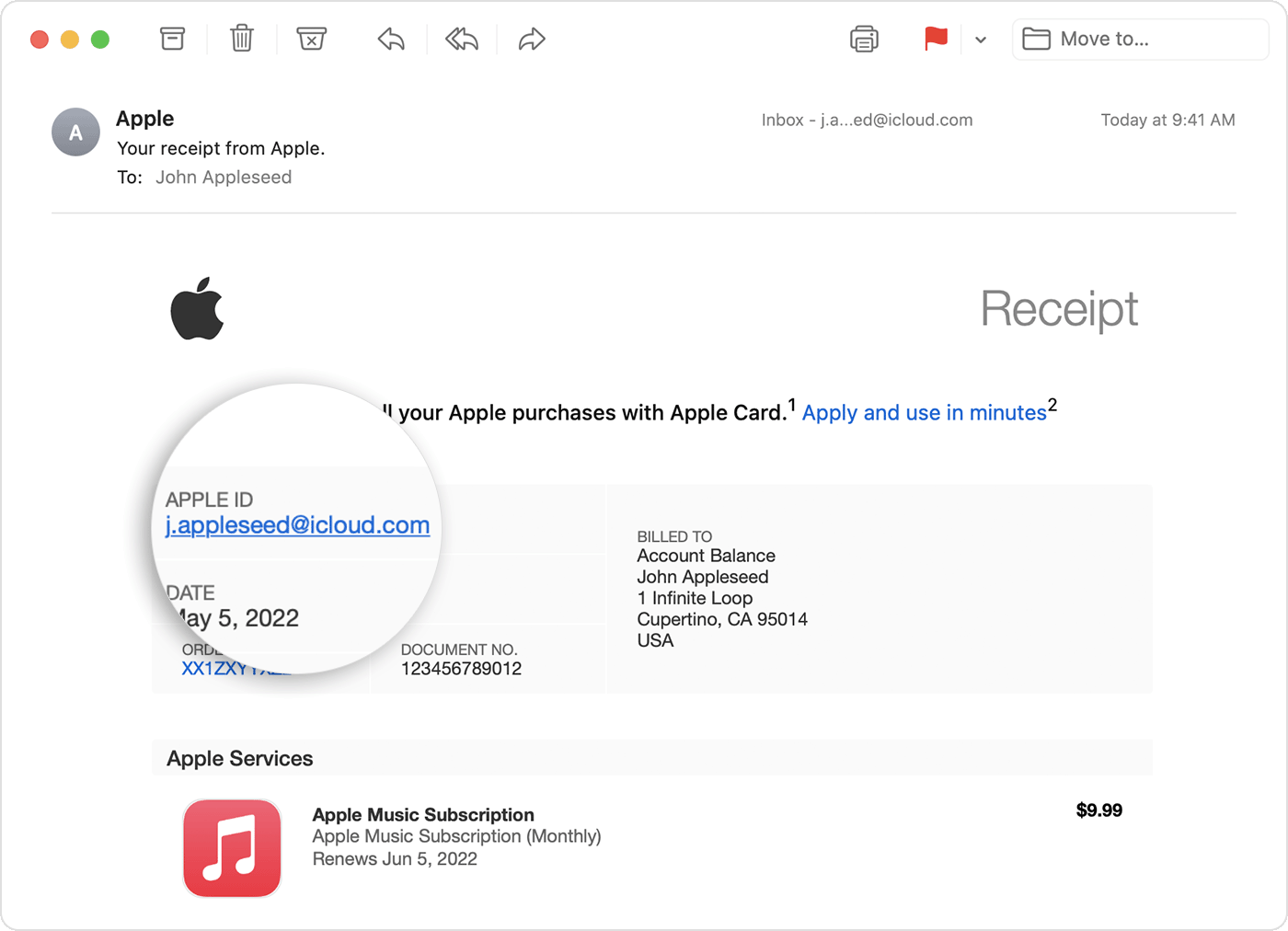

How do I dispute a subscription : Watch your bank or credit card statements.

If a company won't stop charging your account after you've tried to cancel a subscription, file a dispute (also called a “chargeback”) with your credit or debit card. Online: Log onto your credit or debit card online account and go through the dispute process.

How do I permanently cancel a subscription

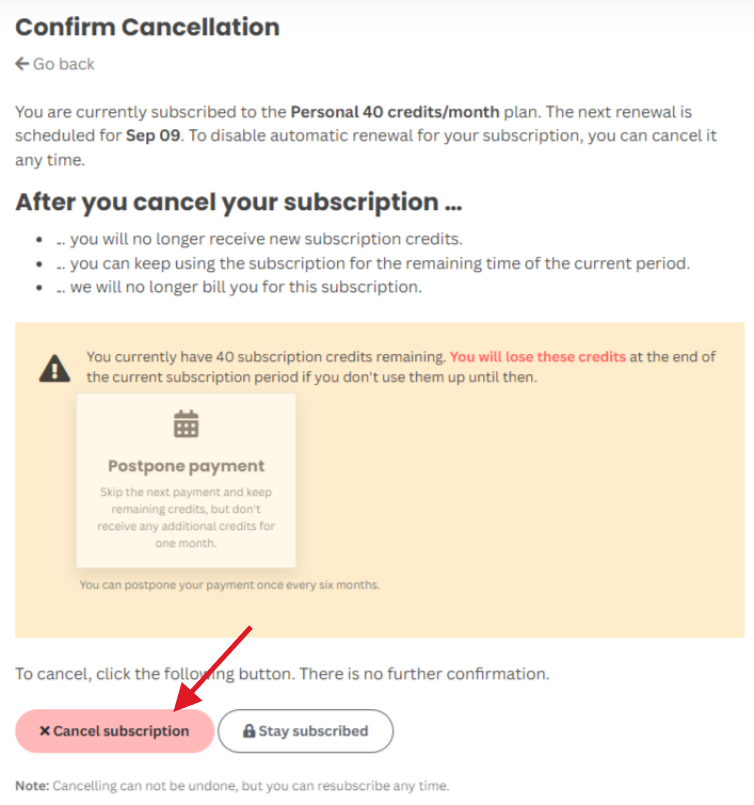

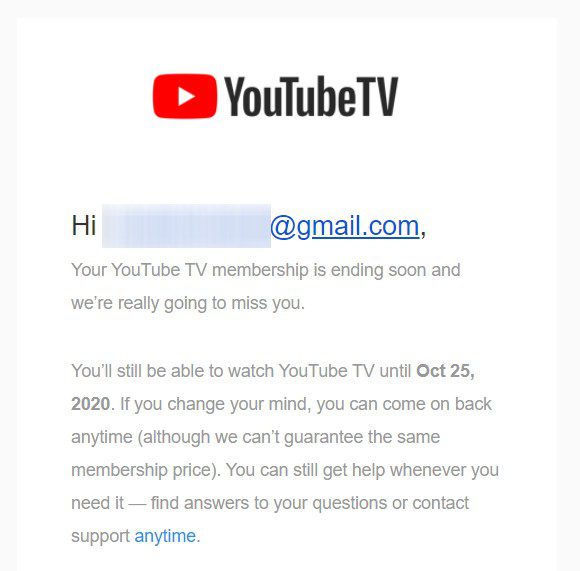

Go to the company's website and sign into your account. Find billing, account, or subscription management settings and look for the cancellation option. Click the Cancel button and follow the provided steps to confirm the cancellation. Look out for the cancellation confirmation email.

How do I block a subscription payment : Call and write the company. Call the company and tell them you are taking away your permission for the company to take automatic payments out of your bank account. The company's customer service should be able to help you, and there might be an online form you can use. Then, follow up by writing a letter or an e-mail.

Call and write the company. Call the company and tell them you are taking away your permission for the company to take automatic payments out of your bank account. The company's customer service should be able to help you, and there might be an online form you can use. Then, follow up by writing a letter or an e-mail.

What's the Time Limit for Filing a Chargeback Each card network and issuing bank sets its own time limits for filing a chargeback, but U.S. law sets a minimum time limit of 60 days. Most banks give cardholders 120 days to dispute a charge.

How do I get out of a subscription trap

Make every effort to contact the company concerned to cancel the agreement. Contact your bank to cancel future payments. Ascertain with your bank whether a new card is needed.On your Android device, go to subscriptions on Google Play. Select the subscription that you want to cancel. Tap Cancel subscription.Contact the company: Contact the merchant's billing or customer service department by phone and state that you no longer want your bank account to be automatically charged. Ask for a fax number, email address, or mailing address for the billing department.

You can contact your bank and place a stop payment order on the recurring transaction. Generally, a stop payment order is only good for six months. To stop payment, you will need to notify your bank at least three business days before the next payment is scheduled to be made. Notice may be made orally or in writing.

How do I cancel a subscription I don’t want : One solution is to send letters revoking your authorization to the subscription company and your bank. Some banks offer ready-made online forms to help you do so. Another way is to give your bank a stop payment order in person, over the phone, or in writing.

Can I call my bank to stop automatic payments : You can contact your bank and place a stop payment order on the recurring transaction. Generally, a stop payment order is only good for six months. To stop payment, you will need to notify your bank at least three business days before the next payment is scheduled to be made. Notice may be made orally or in writing.

Can I dispute a 2 year old transaction

In most cases, cardholders have a 120-day window after that date in which they may dispute a charge.

Federal law only protects cardholders for a limited time — 60 days to be exact — after a fraudulent or incorrect charge has been made.Call and write the company. Call the company and tell them you are taking away your permission for the company to take automatic payments out of your bank account. The company's customer service should be able to help you, and there might be an online form you can use. Then, follow up by writing a letter or an e-mail.

How do I force cancel a subscription : Go to the company's website and sign into your account. Find billing, account, or subscription management settings and look for the cancellation option. Click the Cancel button and follow the provided steps to confirm the cancellation.